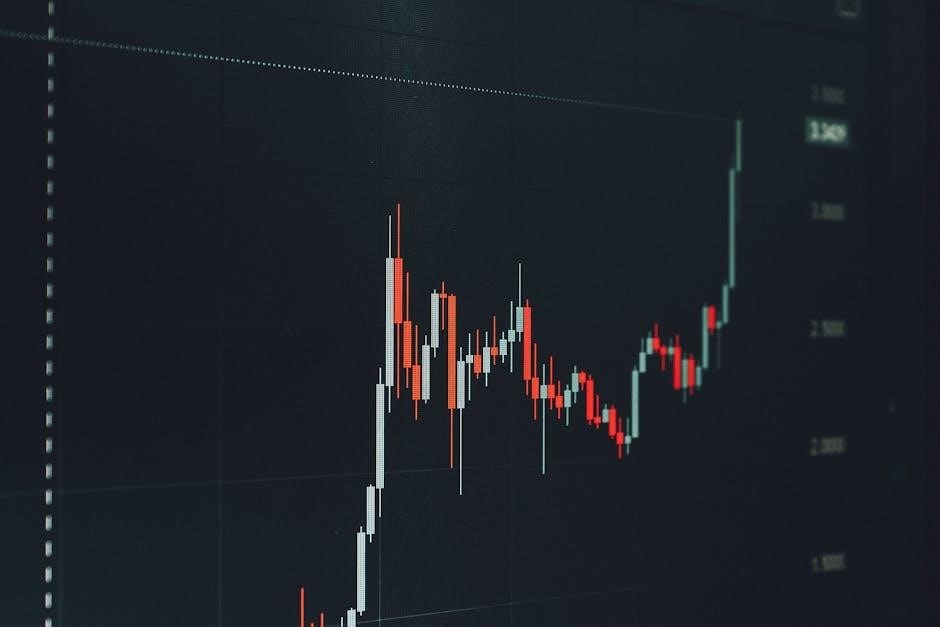

Strategic trading patterns are essential for predicting market movements and making informed decisions. They involve identifying key levels like support and resistance‚ as well as recognizing candlestick formations such as Marubozu candles. These patterns help traders anticipate potential price reversals or continuations‚ enabling them to execute trades with higher accuracy and manage risk effectively.

1.1 Definition and Importance of Strategic Trading Patterns

Strategic trading patterns are visual representations of market behavior‚ helping traders identify potential price movements. These patterns‚ such as support/resistance levels and candlestick formations like Marubozu candles‚ provide insights into market psychology. By analyzing these patterns‚ traders can make informed decisions‚ enhancing profitability; They are crucial for risk management‚ allowing traders to set stop-loss and take-profit levels effectively. Strategic patterns also help in identifying entry and exit points‚ reducing emotional bias. They are a cornerstone of technical analysis‚ enabling traders to anticipate reversals or continuations. Mastery of these patterns is essential for consistent success in dynamic markets‚ making them a fundamental tool for both novice and experienced traders to achieve their financial goals.

1.2 Overview of Common Trading Patterns

Common trading patterns include chart and candlestick formations that signal market trends. Chart patterns like Head and Shoulders‚ Triangles‚ and Wedges indicate potential reversals or continuations. Candlestick patterns‚ such as Marubozu and Hammer‚ reflect market sentiment. These patterns help traders predict price movements‚ enabling better decision-making. They are categorized into bullish and bearish signals‚ guiding traders on when to enter or exit trades. Understanding these patterns is crucial for strategic trading‚ as they provide actionable insights. By recognizing these formations‚ traders can capitalize on emerging trends and manage risks effectively. These patterns are versatile‚ applicable across various markets and timeframes‚ making them indispensable tools for achieving trading objectives. They form the backbone of technical analysis‚ offering clear visual cues for traders to act upon.

Chart Patterns in Strategic Trading

Chart patterns are visual representations of price movements that signal potential market trends. Common patterns include Head and Shoulders‚ Triangles‚ Wedges‚ and Double Tops/Bottoms. These formations help traders identify reversals or continuations‚ enabling strategic decisions. They are powerful tools for predicting price direction and managing risk effectively in various market conditions. By analyzing these patterns‚ traders can gain insights into market psychology and make informed trading choices.

2.1 Head and Shoulders Pattern

The Head and Shoulders pattern is a widely recognized chart formation that often signals a trend reversal. It consists of a central peak (the “head”) and two lower peaks on either side (the “shoulders”). This pattern typically forms after an uptrend‚ indicating potential exhaustion in buying pressure. The “neckline” connects the bases of the shoulders and acts as a support level. A breakdown below the neckline confirms the reversal‚ signaling a potential downtrend; Traders often use this pattern to identify entry points for short positions‚ as it suggests that the market is losing upward momentum. The reliability of the pattern increases with a clear neckline and higher trading volume during the breakdown. It is one of the most reliable reversal patterns in technical analysis.

2.2 Triangle Patterns (Ascending‚ Descending‚ Symmetrical)

Triangle patterns are among the most common and versatile chart formations in technical analysis. They occur when a stock’s price action creates a triangular shape‚ with converging support and resistance lines. There are three main types: ascending‚ descending‚ and symmetrical. The ascending triangle has an upward-sloping support line‚ indicating accumulation‚ while the descending triangle has a downward-sloping resistance line‚ signaling distribution. The symmetrical triangle‚ also known as a pennant‚ has both lines sloping towards each other‚ reflecting a balance between buyers and sellers. These patterns often signal potential breakouts or breakdowns‚ depending on the direction of the price movement. Traders use triangle patterns to identify areas of consolidation and anticipate future price movements. Accurate identification of these patterns can provide high-probability trading opportunities‚ making them a cornerstone of strategic trading strategies.

2.3 Wedge Patterns (Rising and Falling)

Wedge patterns are technical formations that appear on charts‚ signaling potential trend reversals or continuations. A rising wedge forms when the price action creates a pattern with ascending highs and lows‚ converging into a narrow range. This pattern often indicates bearish divergence‚ as the upward momentum weakens. Conversely‚ a falling wedge forms with descending highs and lows‚ suggesting bullish divergence as the downward momentum slows. Both patterns are characterized by a narrowing range‚ and their resolution typically results in a breakout or breakdown. Traders use wedge patterns to anticipate potential trend reversals or continuations‚ often waiting for a confirmed breakout or breakdown before entering a trade. These patterns are valuable for identifying areas of diminishing momentum and planning strategic entries or exits in the market.

2.4 Double Top and Double Bottom Patterns

Double top and double bottom patterns are highly reliable reversal formations in technical analysis. A double top occurs when the price reaches a high‚ retraces‚ then revisits the same high‚ creating two peaks. This pattern often signals the end of an uptrend‚ as it reflects selling pressure at the resistance level. Conversely‚ a double bottom forms when the price drops to a low‚ retraces‚ and then revisits the same low‚ forming two valleys. This pattern typically indicates the end of a downtrend‚ showing buying interest at the support level. Both patterns are confirmed when the price breaks below the neckline (for double tops) or above it (for double bottoms). Traders often use these patterns to identify potential trend reversals‚ combining them with other indicators like volume for stronger signals.

Candlestick Patterns in Strategic Trading

Candlestick patterns are vital tools for traders to gauge market sentiment and predict price movements. They provide insights into buyer and seller behavior through distinct formations like Marubozu and Doji‚ helping traders make informed decisions.

3.1 Bullish and Bearish Marubozu Candles

Bullish Marubozu candles indicate strong buying pressure‚ with prices rising from open to close. Bearish Marubozu candles signal selling dominance‚ as prices drop throughout the session. These candles are significant in identifying market trends and potential reversals‚ aiding traders in making informed decisions. The absence of wicks highlights the single-minded direction of the market during the period‚ making them reliable indicators for strategic trading patterns. Traders often use Marubozu candles to confirm the strength of a trend or the likelihood of a reversal‚ incorporating them into their risk management and trading strategies. Proper identification and interpretation of these candles can enhance trading accuracy and profitability.

3.2 Hammer and Shooting Star Patterns

The Hammer and Shooting Star patterns are pivotal indicators in technical analysis‚ offering insights into potential trend reversals. A Hammer is a bullish signal‚ identified by a small body with a long lower wick‚ indicating that buyers have regained control. Conversely‚ a Shooting Star is bearish‚ characterized by a small body with a long upper wick‚ signaling that sellers are taking charge. These patterns are crucial for traders to recognize‚ as they often appear at the end of an uptrend or downtrend‚ respectively. Traders use these signals to plan entries and exits‚ enhancing their strategies for maximizing profits while minimizing risks. Properly identifying these patterns can significantly improve trading decisions and overall performance in the markets.

3.3 Engulfing Patterns (Bullish and Bearish)

Engulfing patterns are powerful candlestick formations that signal potential trend reversals. A bullish engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle‚ engulfing the previous candle’s body. This indicates strong buying pressure and a shift in momentum. Conversely‚ a bearish engulfing pattern forms when a small bullish candle is followed by a larger bearish candle‚ signaling selling pressure and a potential downtrend. These patterns are often seen at key support or resistance levels‚ making them reliable indicators for traders. They provide clear entry points and are particularly effective when confirmed with other technical indicators or chart patterns‚ helping traders make informed decisions to maximize profitability.

3.4 Doji and Spinning Top Patterns

Doji and Spinning Top patterns are significant in identifying market indecision and potential trend reversals. A Doji candle forms when a security’s opening and closing prices are nearly identical‚ creating a “cross” shape. This indicates a balance between buyers and sellers‚ often signaling a pause or reversal in the current trend. Spinning Top patterns‚ characterized by small bodies and long wicks‚ also reflect indecision. They appear as green or red candles with minimal price movement‚ suggesting that neither bulls nor bears are in control. Both patterns are valuable for traders as they often precede trend reversals or consolidations. Recognizing these formations helps traders anticipate potential shifts in market dynamics‚ allowing for timely adjustments to their strategies. These patterns are especially useful when combined with other indicators for confirmation.

Support and Resistance Levels

Support and resistance levels are critical price barriers where trading activity often reverses or pauses. Identifying these levels helps traders predict potential trend reversals‚ breakouts‚ and aids strategic decisions.

4.1 Identifying Key Support and Resistance Levels

Identifying key support and resistance levels is crucial for strategic trading. These levels are price points where markets often reverse or pause due to buying or selling interest. Traders use historical price data‚ volume analysis‚ and chart patterns to pinpoint these levels. Support levels indicate where buyers may step in‚ while resistance levels suggest where sellers might intervene. By analyzing past market behavior‚ traders can identify these critical zones‚ which often coincide with round numbers‚ previous highs/lows‚ or volume clusters. Candlestick patterns and trendlines also help confirm these levels. Accurate identification of support and resistance is essential for planning entries‚ exits‚ and risk management. These levels are dynamic and can evolve over time‚ requiring continuous monitoring.

4.2 How to Trade Using Support and Resistance

Trading using support and resistance involves utilizing these levels to make strategic decisions. Traders often buy near support levels‚ anticipating a bounce‚ and sell near resistance‚ expecting a reversal. It’s crucial to confirm these levels with other indicators‚ such as candlestick patterns or volume analysis‚ to increase trade accuracy. Stop-loss orders are typically placed below support or above resistance to limit potential losses. Additionally‚ traders may look for breakouts beyond these levels‚ signaling a potential trend continuation. Combining these strategies with risk management practices enhances trading outcomes. Over time‚ support and resistance levels can shift‚ so continuous monitoring and adaptation are essential for successful implementation.

Practical Implementation of Trading Patterns

Applying trading patterns requires refining strategies through practice. Traders must adapt to market conditions‚ manage risks‚ and continuously learn from outcomes to enhance profitability and consistency.

5;1 Risk Management in Pattern Trading

Risk management is crucial for consistent profitability in pattern trading. Techniques like stop-loss orders and position sizing help limit potential losses. Diversifying across patterns reduces exposure‚ while setting risk-reward ratios ensures disciplined exits. Traders must regularly review strategies to adapt to market changes and maintain alignment with financial goals. Proper risk management enhances resilience and sustains long-term success in trading.

5.2 Combining Patterns with Other Trading Tools

Combining trading patterns with other tools enhances strategy effectiveness. Indicators like moving averages or RSI can confirm pattern signals‚ reducing false entries. Oscillators help identify overbought/sold conditions‚ complementing pattern analysis. Trend lines and volume analysis add context‚ improving trade confidence. Risk management tools like stop-loss orders protect capital. Traders should balance tool usage to avoid clutter‚ ensuring each adds unique value. This holistic approach refines strategies‚ boosts efficiency‚ and aligns with market dynamics‚ fostering better decision-making and consistent results.

Strategic trading patterns are powerful tools for navigating financial markets‚ offering insights into potential price movements. By mastering patterns like head and shoulders‚ triangles‚ and candlestick formations‚ traders can improve their decision-making. Support and resistance levels‚ along with risk management‚ are critical for executing trades effectively. To deepen your knowledge‚ explore resources such as “My Favorite Chart Patterns & Trading Setups” and technical analysis guides. Websites like Warrior Trading and Investopedia offer valuable tutorials and webinars. Joining trading communities and forums can also provide practical insights and strategies. Continuous learning and practice are key to refining your skills and achieving consistent results in the markets.